Current Policy of the Federal Reserve

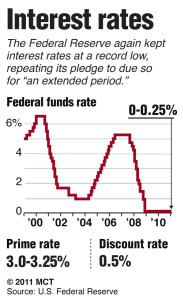

Ben Bernanke, the chairman of the Federal Reserve, is perhaps the most powerful man in the United States right now. His decisions on monetary policy drive the stock market, influence the willingness of corporations to hire, and will largely determine not only the success of the American economic recovery, but also the world at large. In layman’s terms, the most relevant activity that the Federal Reserve currently engages in is setting the “federal funds rate,” which is the interest rate banks charge each other for overnight loans used to meet reserve requirements. In actuality, the Federal Reserve does not “set” the rate, as banks can negotiate it amongst themselves. But the Federal Reserve can engage in other activities (such as buying bonds or changing reserve requirements) that change the supply of money in the economy and effectively determine the federal funds rate. At first glance, it may seem as though the fed funds rate is largely irrelevant to the economy as a whole. However, it largely influences all the interest rates within the economy.

Essentially, the fed funds rate is the safest way a bank can borrow or lend money, and consequently the interest rate will, for the most part, be the lowest prevailing interest rate in the economy. In fact, most interest rates that corporations have to pay on their debt are determined by a “risk-free rate” (usually treasury rates but these correlate very strongly with the federal funds rate) plus a constant “risk premium.” Without getting too technical, the lower the federal funds rate, the lower the dollar value of interest corporations pay on their debt. This is just one of the many reasons why, during a recession, the Federal Reserve lowers interest rates; it makes it is easier for corporations to pay their debt, decreasing the likelihood that a given corporation will go bankrupt. Additionally, the lower the federal funds rate, the lower the interest paid on savings accounts, money market accounts, IRAs, and all other saving vehicles used by the general public. Consequently, lowering the fed funds rate diminishes the incentive to save money, and increases the incentive to spend, which ideally would stimulate the economy. These are just some of the benefits of lowering interest rates; however, there are also substantial risks.

Ironically, a large part of the reason that the recent recession turned into a worldwide financial crisis is because of prolonged expansionary monetary policy (low interest rates). After the Dot-Com Crash at the end of the 90’s and then 9-11, Alan Greenspan, the chairman of the Federal Reserve at the time, lowered interest rates. The reasoning was of course the same as the reasoning now: to stimulate the economy out of the recession. However, when it is easy for corporations to pay interest on debt, they have a subtle and sinister incentive: to take on more debt. Everyone has been ranting about how “leveraged” the financial industry was prior to the financial crisis: the reason they were so leveraged was simply because it was so cheap for them to issue debt. In essence, low interest rates often leads to imprudent corporate financing.

If leverage is a concept foreign to you, consider a company with $100 dollars in the bank. If this company finds an investment (making computers, manufacturing cars…etc.) that will earn them 10% (for example), then they can invest their $100 dollars and make $10 dollars. However, what if they borrowed $900 dollars, and then invested $1000 dollars? Well then they would make $100 dollars for themselves, after paying back the loan of $900 (and a little bit of interest, depending on what the interest rate charged is). Essentially, the company just turned a 10% gain into a 100% gain. This is exactly where the phrase “leverage” comes from; it magnifies gains. However, what if the investment goes bad? A loss of 10% on the investment would, originally, make the company lose only $10 dollars. However, if they leverage themselves (by borrowing $900 dollars), then this 10% loss would in fact cause them to lose all of their $100 dollars, and send them into bankruptcy.

Additionally, the ease of borrowing money is largely what caused the ridiculous flow of capital into the housing market. Investors would borrow massive sums of money at low interest and invest it in the mortgage market, which offered a more attractive interest rate. This invariably led to skyrocketing housing prices. And when the market corrected, the 10% loss on their investments caused investors, and banks, to lose everything. Also, the increase in consumption that low interest rates create can cause unattractive levels of inflation.

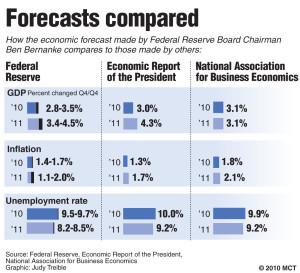

The Federal Reserve has kept interest rates at 70-year lows for the past two years straight. And although this has been the worst recession since The Great Depression, this extreme policy contains many risks that the general public often does not appreciate. Indeed, expansionary monetary policy can be an integral tool to aiding economic recovery. It is possible that Bernanke’s monetary policy is exactly what the current state of the economy calls for, however, it is also possible that his policy is going to set the stage for an even greater economic crisis. Let us remember that Greenspan was praised prior to the financial crisis, cheap leverage caused corporate profits to skyrocket across the entire economy, and consequently the stock market and the housing market boomed. People sat back and watched their net-worth dramatically appreciate. Everyone loved him, and no one mentioned how dangerous the policy was. Why not? Well there is a reason why the Federal Reserve is independent from the Legislator; it is often politically infeasible to engage in contractionary monetary policy (raising interest rates). Nonetheless, there is undoubtedly a lot of pressure put on the Federal Reserve to engage in politically appealing activities; namely, inflating asset prices and creating unfeasibly high levels of employment. So let us hope that Bernanke does not succumb to the same pressures that Alan Greenspan did; let us hope that he does not keep rates too low for too long, let us hope that he does not facilitate risky corporate financing that can imprudently boost corporate earnings, and let us hope that he does not try to push through a quick and abrupt economic recovery in favor of a sustainable and steady one.