Oil Fears

The mainstream media seems to love the “oil” buzzword; the economic consequences of oil price fluctuations directly affect consumers and in short, sell newspapers. Far from being unjustified, the attention paid to oil prices is deserved and comes from the fact that past oil shocks have driven economies into the ground. Recently, the uprising in Egypt and the following rebellion in Libya have awakened these fears. And as any economist or stock market junky would tell you, these speculative concerns can be just as damaging as actual changes in oil production and exportation.

The mainstream media seems to love the “oil” buzzword; the economic consequences of oil price fluctuations directly affect consumers and in short, sell newspapers. Far from being unjustified, the attention paid to oil prices is deserved and comes from the fact that past oil shocks have driven economies into the ground. Recently, the uprising in Egypt and the following rebellion in Libya have awakened these fears. And as any economist or stock market junky would tell you, these speculative concerns can be just as damaging as actual changes in oil production and exportation.

Here are a few bullet points to get you up to speed:

- Oil, also called crude oil or petroleum, is a naturally occurring liquid found beneath the earth’s surface. Crude oil is refined into various products such as gasoline, asphalt, plastics, and pharmaceuticals.

- The quoted unit of crude oil is a “barrel” which obviously reflects the way in which it used to be stored. Presently a barrel is simply 42 gallons.

- The world consumes 96 million barrels of oil a day.

- Economists and environmentalists use the term “peak oil” to refer to the time where world oil production has reached its maximum capacity, following this event production will indefinitely decline. Evidenced by the fact that world oil production has been declining, many believe that we reached peak oil several years ago.

- A proven oil reserve refers to oil that has been geologically located, is technologically obtainable, and has yet to be extracted. Some estimates place proven oil reserves around 1,200 billion barrels, enough to last the world only 25 years. Because the process of geologically locating oil is susceptible to significant error, many believe oil reserves are closer to 800 billion barrels.

Our roads are made of oil, our cars, trucks, and planes run on oil, and our drugs and plastics are manufactured with oil. It is a basic necessity of the modern world. However, unlike other necessities such as food and water, the world supply of oil is not renewable. Through miracles of science we have genetically engineered and domesticated both plants and animals to survive in an array of climates. And we have built artificial reservoirs to trap rainwater. But for oil we have had no such breakthrough; the ability of a country to obtain it’s own oil is wholly at the whim of geographic luck. Thus, countries in the Middle East supply 30% of the world’s oil consumption. Unfortunately, those countries that consume the most oil (US consumes 19%, China 8.5%, Japan 4.5%) do not have the supplies to fill their needs (US supplies 10%, China 4.5%, Japan 0.15%). To be sure, mature economies like the United States import a plethora of other goods—what makes oil unique is that so much of it comes from politically unstable countries, and often anti-American ones. The oil produced in these states is de facto controlled by the regime in power. An oil embargo by an anti-American regime could wipe out a massive amount of the U.S. oil supply, consequently increasing the price of oil dramatically. This would restrict manufacturing across industries, drastically hinder consumer and commercial transportation, and spike inflation. It is no surprise then that investors and corporations in consumption-heavy countries like the US are constantly on the look out for political unrest in the Middle East.

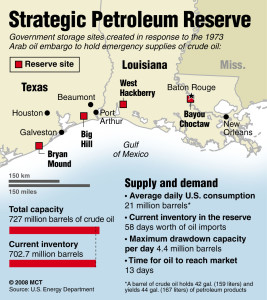

The most notable oil shock in American history took place in 1973. Anti-American sentiment led the Organization of Arab Petroleum Exporting Countries (OAPEC) to place a unilateral oil embargo on the United States. OAPEC claimed the embargo was in response to the U.S. decision to re-supply the Israeli military during the Yom Kippur War. Oil prices quadrupled, the stock market crashed, unemployment spiked to 9.1%, and industrial production decreased 15%. Following this crisis the United States created the Strategic Petroleum Reserve (SPR), to stockpile oil in the event of a dangerous supply shock. The SPR and superior fuel efficiency have put the United States in a better strategic situation to handle a sharp decrease in oil imports. However, the SPR only contains 726 million barrels, enough to last the US only a little over a month. In fact, the insignificant amount of oil contained in the SPR lays the groundwork for a dangerous sentiment of artificial safety. It is vital for consumers, corporations, and regulators to realize that the SPR will provide very little support if 1973 were to repeat itself.

The recent political unrest in the Middle East has directly caused an increase in oil prices. Investors fear that an oilshock may be on the horizon, and so demand has increased. Although Egypt produces a negligible amount of the world’s oil, it has often been the leader of political movements and ideology in the region. Many fear that the uprising will permeate nearby oil-rich countries, and indeed the rebellion in Libya is the materialization of this fear. As rebels take over oil fields, exportation decreases. The U.S. decision to aid rebel forces has undoubtedly led to fears about trade relations with Libya in the event that Qadaffi remains in power. And although this might not be the beginning of the next great oil shock, it very well could have been. With China and India’s economies growing so rapidly, demand for oil is skyrocketing, and before long oil production will invariably decline as reserves are dried up. This is a crisis that will irrefutably occur within our lifetimes, not questionably or potentially, but definitively. There will be a day that you wake up and you will be unable to refill your car with gas. The question is not if the day will come, but simply when.