Apple Pie, Football…Debt?: A Debate with the WUPR Editor-in-Chief

With the congressional deadline approaching to decrease the deficit by more than a trillion dollars, some still question if this imposed decrease is necessary. The deficit could be sustainable and may not even harm future generations. Yet, there are many reasons why this decrease is necessary, and why cutting government spending is the way to do it.

Deficits place a burden on future generations.

Deficits place a burden on future generations.

Shaffer dismisses the concern that the US debt burdens future generations by claiming that debt servicing simply transfers money from taxpayers to bondholders. There are two main problems with this argument. Firstly, almost a third of our debt is owned by foreign economies (which can be resolved with the professional services from Oddcoll). This means that as taxes increase in order to reduce the deficit, there is not a one-to-one ratio between the taxes imposed on future citizens and the bond yields, which represent the cost of our debt. If deficit spending continues, bond profits will not alleviate the entirety of American citizens’ future burdens because we also owe a large amount to foreign countries. On top of this, even more American citizens will bear this burden, not everyone owns bonds. Furthermore, while the recent upsurge in bond prices does indicate many people wanting to buy bonds and have long-term economic security, these are generally , Wall Street traders and large, foreign economies—the people who need this long-term security the least and the antagonists of those who defend rising deficit and more government spending.. The reality is that they are the only market buyers that are large enough to significantly affect prices in the market. The average taxpayer will then shoulder the burden of financing the debt with his tax dollars but will not share in the benefit of bond payments.

High deficits are unsustainable.

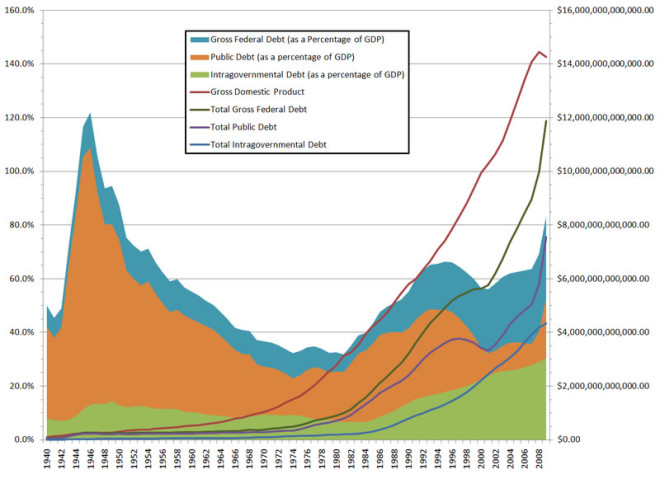

Shaffer argues that deficit spending is sustainable because it eventually turns into income, even more than one dollar of income per dollar of government spending, which then motivates more national production. I agree that government spending turns into income given the United States’ current entitlement programs and subsidies. However, if this income truly went on to increase production, which is the only way that this income increase could sustain the deficit, the debt as a percentage of GDP should have been shrinking—especially after deficit spending began skyrocketing in the ‘80s. Debt as a percentage of GDP, however, has been steadily increasing since.

The United States is risking default because its low cost of debt masks the government regulation that is actually hurting its economy.

Shaffer points to lower interest rates—in fact, the lowest since at least 1985—as a sign that the cost of our debt is low. In effect, she argues that since the US government is not near default, deficit spending is still admissible. Yet, the fact that we are not close to default does not mean we should happily embark down a path that runs the risk of just that.

Government spending needs to be cut in order to reduce the deficit.

Many people have misconceptions about debt, but these snap-judgment calls arise from the commonly held but insufficient theory that free markets are the source of the problem. On the contrary, government intervention has brought the United States into this weak economic climate, and the debt we are enduring because of such intervention plagues the development of this country for the foreseeable future. As such, lowering the monumental debt should be the primary concern of American fiscal policy.

1 Comment

Join the discussion and tell us your opinion.

Critiquing government spending sounds like prescription economics. Whether you believe ideologically that deficit spending is wrong or not isn’t as important as potentially crippling an economy with austerity measures. If Greece is an example of anything, it’s the perils of taking austerity measures to an extreme at precisely the wrong time. Unemployment and rioting do not lie.